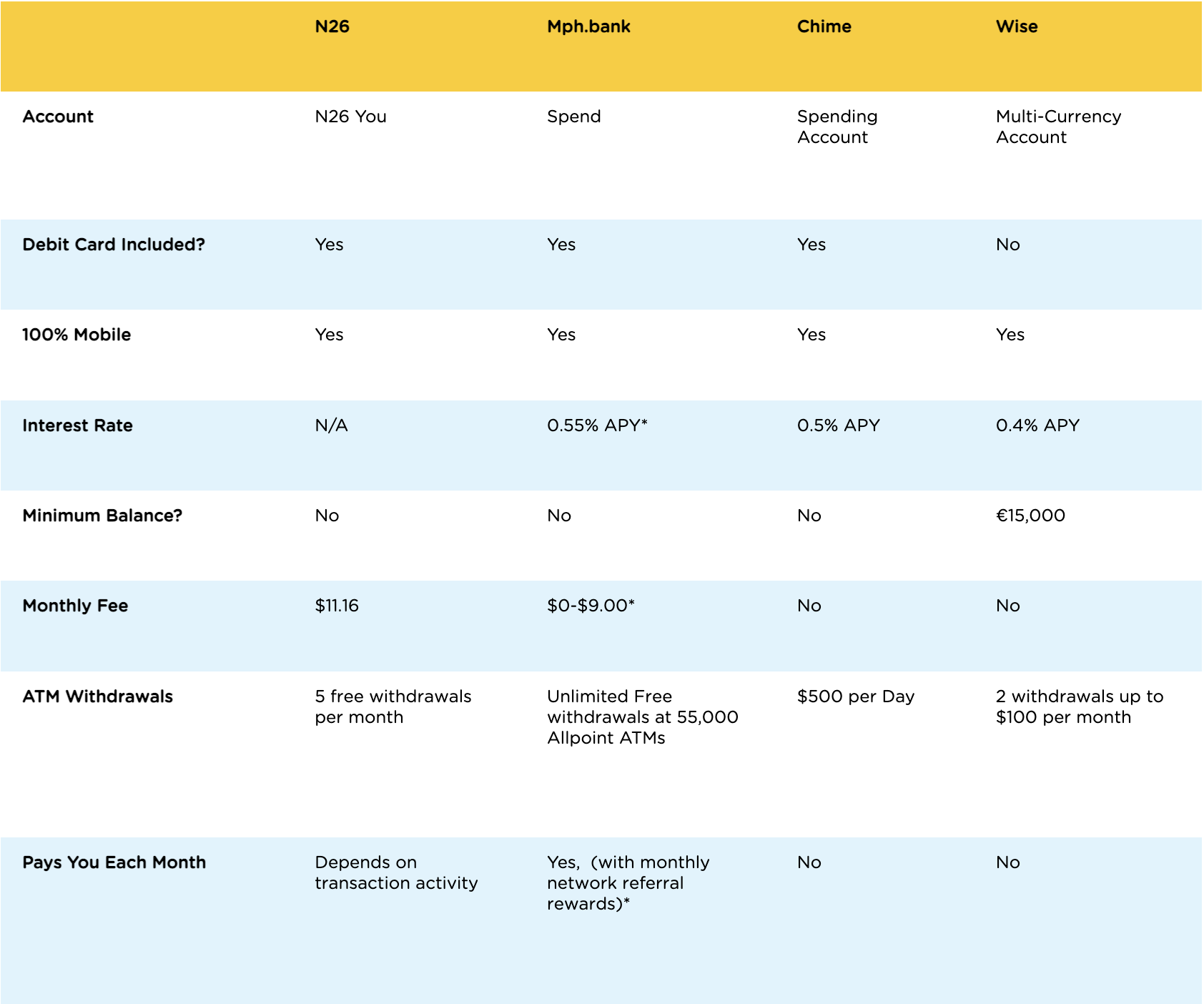

As German-based fintech N26 prepares to close its doors to their United States market in early January 2022, the company’s 500,000 US customers are scrambling to find a new bank to transfer their funds into.

To help narrow down their broad options, here’s how N26 compares to similar US-based fintech’s.

* You must complete 15 debit card transactions (excluding ATM transactions) each month (between the 1st and last Business day of such month) using the mph.bank debit card linked to your account to unlock these features: 0.55% Annual Percentage Yield (APY) on your Spend account balance up to $5,000, waiver of the monthly $9 membership fee, and the ability to earn Referral Rewards. The default rate, and for all balances above $5,000, is 0.00% APY. Fees could reduce earnings.

To earn monthly Referral Rewards, you must have 15 mphCard (debit) transactions (excluding ATM transactions) post each month (between the 1st and last business day of such month) using the mphCard linked to your account. After that, you will get paid one dollar ($1.00) each month for each verified referred connection (up to six degrees) that completes 15 mphCard qualified transactions each month using the mphCard linked to their account. Each member is limited to earning $8,500 referral rewards per month. See full account agreement information for additional terms and conditions.

The FDIC National Average APY for an interest-bearing checking account is 0.03% APY as of 7/2/2021.

Rates listed are effective 7.27.21 and are subject to change without notice. Some fees may apply, refer to our current Schedule of Fees. All deposit products are provided by, and mph.bank is a brand of, Liberty Savings Bank, F.S.B., Member FDIC.

What do fish use as currency to purchase anything?

Sand Dollars! Sign up to receive important information on banking, financial tips, and jokes like this directly to your inbox