Starting the journey of higher education brings excitement and the need to manage personal finances. Budgeting is crucial for college students, and in this article, we will explore the top five budgeting apps designed specifically for students. These apps empower you to take control of your finances, track expenses, and set achievable savings goals. By developing smart money management habits, these tools relieve financial stress and pave the way for long-lasting financial success throughout your college years. Let's dive into the world of budgeting and discover the tools that revolutionize personal finance.

Related Article: 10 Ways to Help Reduce Impulse Buying

understanding the importance of budgeting for college students

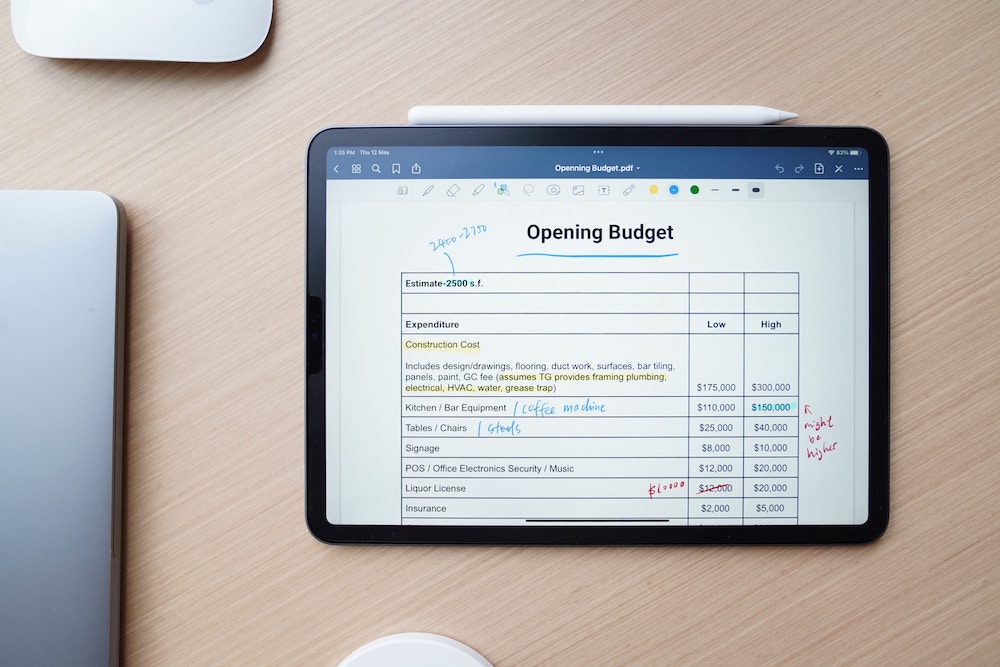

Mastering the art of budgeting is a vital skill enabling you to effectively manage your finances and steer clear of unnecessary debt. By creating a budget, you can keep a close eye on your income and expenses, prioritize your spending, and set aside funds for future needs. Moreover, budgeting instills financial responsibility and imparts a valuable understanding of the true worth of money.

With the power of budgeting, you can avoid the pitfall of overspending and instead live within your means. It empowers you to make well-informed financial decisions and resist the temptation of impulsive purchases. By gaining a clear understanding of your financial situation, you can plan for unexpected emergencies, diligently repay student loans, and proactively save for your future aspirations.

In essence, budgeting is an indispensable tool for you, the college student, granting you control over your finances, alleviating stress, and nurturing lifelong financial habits.

Key Features to Look for in Budgeting Apps for College Students

When choosing a budgeting app, you should consider several key features that can enhance your financial management experience. These features include:

1. Expense Tracking

A good budgeting app should allow you to track your expenses easily. It should provide options to categorize expenses, set spending limits, and generate reports for better analysis.

2. Budget Creation and Monitoring

The app should offer tools to create a budget plan based on your income and expenses. It should allow you to set financial goals, monitor your progress, and receive notifications for overspending or exceeding budget limits.

3. Bill Reminders

Many college students have recurring bills to pay, such as rent, utilities, and student loans. A budgeting app should include bill reminders to help you avoid late fees and penalties.

4. Savings Goals

An ideal app should have features that allow you to set savings goals and track your progress. It should provide insights and tips to help you save money efficiently.

5. User-Friendly Interface

A budgeting app should have an intuitive and user-friendly interface to make financial management easy for you. It should be accessible on both mobile devices and computers for convenience.

1. Mint: Features and Benefits

Mint is a comprehensive budgeting app that allows you to track your spending, create budgets, and set financial goals. It categorizes transactions automatically, provides insights into your spending habits, and sends alerts for upcoming bills. Mint syncs with your bank accounts and credit cards to provide a real-time overview of your financial situation.

2. PocketGuard: Features and Benefits

PocketGuard helps you track your spending, set budget goals, and monitor your financial health. It categorizes transactions, shows how much money is available after bills and savings, and provides insights into your spending patterns. It also helps you find opportunities to save by suggesting budget adjustments.

3. Goodbudget: Features and Benefits

Goodbudget is based on the envelope budgeting system, where you allocate a certain amount of money to different spending categories. It allows for collaborative budgeting, making it suitable for roommates or shared expenses. The app provides real-time updates on spending and helps you stay on track with your financial goals.

4. Wally: Features and Benefits

Wally is a simple and user-friendly budgeting app that focuses on tracking expenses. You can take pictures of receipts to easily log transactions, set savings goals, and gain insights into your spending patterns. Wally also supports budgeting for various categories, helping you maintain control over your finances.

5. YNAB (You Need A Budget): Features and Benefits

YNAB is a popular budgeting app that follows the zero-based budgeting approach. It helps you give every dollar a job, prioritize spending, and break the paycheck-to-paycheck cycle. YNAB provides educational resources to help you build better financial habits and gain control over your money.

Before choosing an app, consider factors such as ease of use, compatibility with your financial institutions, and any additional features that may be important to you. Additionally, check for the most recent reviews and updates for each app to ensure they still meet your requirements.

What do fish use as currency to purchase anything?

Sand Dollars! Sign up to receive important information on banking, financial tips, and jokes like this directly to your inbox